Zefiro Methane - Letter from the Interim CEO to Shareholders

From Catherine Flax: July 15, 2025

To Zefiro’s Investors, Partners, Collaborators, and Friends,

Although we are barely halfway into the year 2025, this year has been one of great change for Zefiro… both within the organization, and for the broader market landscape in which the company operates. As a seed investor in Zefiro and a founding member of the team, my view is that these changes are indicative of very exciting times to come… and in just one month as Interim CEO of Zefiro Methane Corp., a course has been charted for us to realize many great achievements in 2025 and beyond as an innovator and market leader in the environmental services space!

I would like to thank you all for your continued support of Zefiro. Whether you were with us in the early 2020s as the Zefiro concept was first being conceived, or whether you became aware of Zefiro more recently such as hearing about the company when we’ve been in the news lately, we are endlessly grateful for everyone who has believed in us, opened doors for us, and stayed with us as we navigate this matrix of change while continuing to perform and actively deliver results.

Last month, I officially became Interim CEO of Zefiro following the departure of the company’s Founder and CEO, Talal Debs. With several moving parts to the business, there has been much to do in terms of optimizing the company for long-term growth and success. However, having been here from day one… I am fortunate enough to have full context with respect to the ins and outs of Zefiro as an organization, as well as the challenges the company has been facing.

My plan is to overcome those challenges and refocus Zefiro on maximizing its current opportunities, as well as to capture and execute new business.

To succinctly describe my playbook as Zefiro’s Interim CEO, there are three primary goals that define management’s priorities as of July 2025:

- Building Revenue of Zefiro’s Core Business: Demand for environmental remediation services in key markets for Zefiro and its subsidiaries has not slowed down, which was reflected by growth of approximately 5% between the first three quarters of Zefiro’s fiscal 2025 year (in which Zefiro generated USD $24.4 million in revenue), versus the first three quarters of Zefiro’s fiscal 2024 year. We have announced new contracts that we have won, and we are making it a top priority to continue carrying this growth momentum as the backbone of driving shareholder value.

- Reducing Overhead or “Burn” Expenses: We are taking several steps to lower Zefiro’s operating costs, which has already helped considerably to strengthen the company’s balance sheet.

- Delivering Zefiro’s First Emission Offset Credits: With pre-sales of carbon offsets already made to both Mercuria and EDF Trading, we are working actively to tie off the remaining loose ends in order to successfully issue and deliver these credits, which will officially debut another stream of revenue for Zefiro.

Zefiro has always been very special to me at a personal level, because it addresses a serious issue in the energy industry with far-reaching environmental, social, and commercial implications. Although unplugged oil and gas wells are viewed as a “nuisance” liability, Zefiro has found a way to generate business value from remediating these sites. Our business model works whether it is by partnering with oil and gas companies who need to remediate existing wells, providing services to government agencies who are carrying out well remediation projects, or through the origination of carbon credits from eliminating emissions by decommissioning leaking wells.

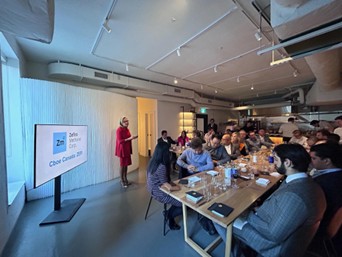

Toronto, Ontario, Canada on April 22, 2024: The day before Zefiro’s debut on the stock market, I delivered a presentation in front of several investors in the company’s IPO as well as management team members and other partners and stakeholders who all helped to shape Zefiro into what it is today!

My passion for the energy business comes from the early days of my career in investment banking. I had a number of roles in sales and trading, before joining J.P. Morgan in 2005. That is actually where a very pivotal event in Zefiro’s formation took place… it was J.P. Morgan where I met carbon trader extraordinaire Tina Reine, who now serves as Zefiro’s Chief Commercial Officer. Tina was the driving force behind Zefiro’s carbon credit pre-sales to Mercuria and EDF Trading, among many other developments in our carbon business. At J.P. Morgan, I served as CEO of the Commodities business for Europe, Middle East and Africa, and went on to run Commodities, Foreign Exchange and Emerging Market Sales and Trading at BNP Paribas for the Americas. The energy business continues to evolve and it has been a privilege to have a front row seat in an industry that is so important to the world economy.

I wanted to ensure a few words from Tina are included in this letter, so here is what she would like to share with you all:

Tina Reine at COP28 in Dubai

“For the past several years, there has been a sustained demand for high-quality carbon offsets originated from American-based projects with a proven and measurable impact on reducing or eliminating emissions from sources such as unplugged oil and gas wells.

Zefiro has been ticking all of the boxes in terms of how much of an impact our projects have made, the integrity of our data pertaining to each project, and how well we have been able to demonstrate the ‘Additionality’ of these projects… which means that the earnings from the sale of carbon credits is exactly what made these remediation projects possible in the first place.

It is a great pleasure to work directly for Catherine Flax once again, who was the best boss I ever had when we were working at J.P. Morgan together. We have several notable developments on the horizon, which are going to make 2025 a very exciting year for Zefiro!”

Another very important member of Zefiro’s core management team is Luke Plants. In addition to serving as Zefiro’s Senior Vice President of Corporate Development, Luke also heads Zefiro subsidiary Plants & Goodwin, Inc. (“P&G”) as its Chief Executive Officer, representing the third generation of family management since P&G was founded in 1970. Over the past 55 years, P&G has built up a significant commercial footprint in the Appalachia region, including Pennsylvania… which is where America’s first oil boom began with the Drake Well in 1859.

Luke is a savvy, energetic, and very knowledgeable business leader who was hand-picked to make a statement in the 2024 Orphaned Wells Program Annual Report to Congress for the U.S. Department of the Interior (“DOI”), where he spoke about the impact of the Bipartisan Infrastructure Law on P&G’s business, which was able to expand its workforce by 40% as a direct result of this funding. He was also featured in a 2023 episode of BBC News’ Future Earth, where he explained the seriousness of methane emissions and how P&G is playing a significant role in cleaning up the orphaned and abandoned wells that are contributing to this problem.

Here is what Luke Plants would like to share with the readers of this letter:

“In the 2020s, there is no shortage of funding when it comes to environmental remediation projects. Whether that funding comes from government grants or private companies and land owners, it is widely understood at this point that every dollar spent today to plug wells and prevent leaks of toxic gases such as methane has an infinite long-term impact on the communities and ecosystems that are affected or stand to be affected by these leaks. As an established multi-state operator in Appalachia, where there is a dense concentration of these wells, becoming part of Zefiro has enabled us to scale our capacity and reach like never before. As efforts to remediate unplugged oil and gas wells across America continue to ramp up, we are actively capitalizing on this demand and are taking initiatives to enhance our bandwidth and maximize our environmental impact as well as value to shareholders.”

Luke Plants speaks during an episode of BBC News’ Future Earth, detailing the effects of methane leaks and how P&G is working actively to remediate unplugged oil and gas wells which could be emitting methane

In closing, I would like to once again say “Thank You” to everyone who has shown their dedication to Zefiro as we have navigated many unique changes and challenges, which have often proven to be opportunities if approached strategically. I have doubled down on my personal commitment to Zefiro many times, between having put in additional capital of my own to support the company’s operations, and becoming its Interim CEO as of last month. It is a mission that I very much believe in, and it is so reassuring to be supported by many others who are equally enthusiastic about Zefiro and the impact we strive to create.

There is a very bright future ahead of us for Zefiro in both the near-term and the long-term, and we truly could not have gotten this far without your continued support!

Yours very truly,

Catherine Flax

Interim CEO of Zefiro Methane Corp.

P.S. Please stay tuned for an episode of the Smarter Markets podcast that will go live later this summer, in which I will be interviewed in my capacity as Zefiro’s Interim CEO. Last year, I spoke on this podcast about “The Future of Energy”. The 30-minute episode can be listened to by clicking here.

Disclaimer

This letter may contain forward-looking statements within the meaning of applicable securities laws, including, U.S. and Canadian securities regulations and laws. These forward-looking statements are based on current expectations, estimates, projections, beliefs, and assumptions of management, including those of Zefiro Methane Corp., as of the date of this letter.

Forward-looking statements typically include words such as “anticipate,” “expect,” “intend,” “plan,” “believe,” “estimate,” “may,” “will,” “should,” “could,” “would,” “continue,” “forecast,” “potential,” “target,” “goal,” “vision,” “strategy,” and similar expressions or variations thereof. These statements may relate to, among other things, the company’s strategic initiatives, business plans, regulatory environment, growth prospects, financial performance, operational outlook, timing and scope of projects, future market conditions, funding and capital requirements, partnerships, or other business developments.

Such statements are not guarantees of future performance and are subject to a number of known and unknown risks, uncertainties, and other factors—many of which are outside the company’s control—that could cause actual results or outcomes to differ materially from those expressed or implied by such forward-looking statements. These factors include, but are not limited to: fluctuations in commodity prices, changes in regulatory or political environments, operational risks, financing risks, market demand for emissions reduction or environmental services, delays in project execution, reliance on third-party partners or vendors, competition, and the overall economic environment.

Also, this letter may include market and industry data obtained from various publicly available sources and other sources believed by the Company to be true. Although the Company believes it to be reliable, the Company has not independently verified any of the data from third-party sources referred to in this presentation or analyzed or verified the underlying reports relied upon or referred to by such sources, or ascertained the underlying assumptions relied upon by such sources. The Company does not make any representation as to the accuracy of such information.

Zefiro Methane Corp. does not undertake any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by applicable law. Readers are cautioned not to place undue reliance on these forward-looking statements.

This letter is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities of Zefiro Methane Corp., nor shall it form the basis of or be relied upon in connection with any investment decision.